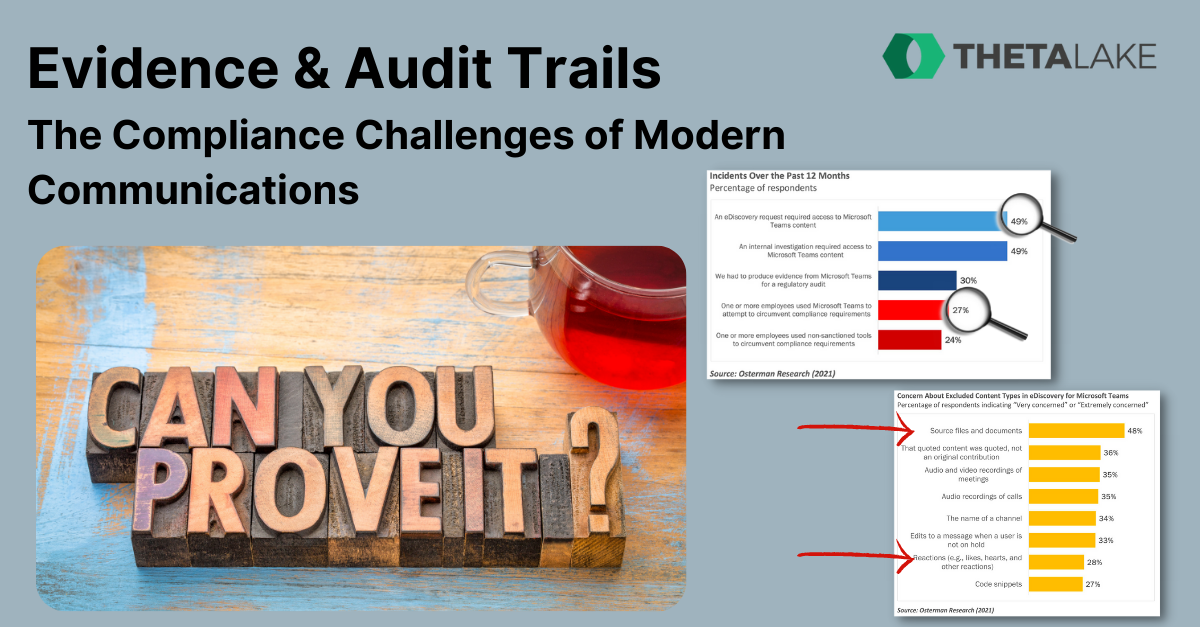

Collaboration tools like Microsoft Teams, Zoom and Webex Teams, RingCentral and Slack have become integral to how we work. With multiple ways to communicate and collaborate they’re vital for keeping workforces and customers connected whether remote, hybrid or office based. And with less and less physical in-person interaction, users are making use of the rich features to liaise and share information. Not least by adding personality and emotion with emojis, reactions and GIFs. But modern communications create compliance challenges when it comes to providing evidence and proof that is so often required for regulatory, HR, litigation or complaints resolution issues.

Evidence & Audit Trails - The Compliance Challenges of Modern Communications

Topics: compliance, chat compliance, record-keeping, financial services, evidence

Our Response to Regulators on AI and ML in Financial Services

Last month Theta Lake submitted a response to a request for comment from several federal banking agencies including the Federal Reserve, the Consumer Financial Protection Bureau, and the Office of the Comptroller of the Currency about the use of Artificial Intelligence (AI) and Machine Learning (ML) in financial services. In our response, we described how Theta Lake uses AI in its Security and Compliance Suite, offered thoughts about how the agencies might create a framework for assessing AI risk, and outlined a few standard practices that would facilitate strong AI development in the future.

Topics: voice compliance, regtech, surveillance, financial services