Topics: funding

Fintech, regtech and the role of compliance in 2022: Challenges arising from technological opportunities

Digital transformation has been a fundamental enabler for financial services firms. It is hard to underestimate the opportunities and regulatory benefits firms can derive from the implementation of technological solutions but maximising their potential can present challenges. Thomson Reuters Regulatory Intelligence's sixth annual survey and report on fintech, regtech and the role of compliance explores these challenges, particularly in the context of corporate governance and risk management.

Topics: compliance, regtech, supervision, monitoring, return to work, regulations, communications

Redefining Compliance in the Modern Workplace - A recap of 2021

It is undeniable that how we communicate in the workplace has been forever changed. With over 83 percent of organizations not leveraging all the capabilities of their collaboration platforms, including Webex, Microsoft Teams, Zoom, Slack, and more. Our team has played an integral role in advancing collaboration platforms and empowering organizations to securely embrace these platforms to maintain daily business operations.

Topics: survey, return to work, communications

10 Predictions for 2022: Communications, Collaboration, and Compliance

The last two years have brought tremendous change, forcing us all to adapt and adopt technology, processes, and initiatives to stay connected virtually in an era where live interaction has been mostly restricted. The communication and collaboration market was front and center in making this possible.

Topics: compliance, predictions, surveillance, electronic communications, communications, collaboration

Cryptocurrency Detections in Video, Voice, Chat - More than just keywords

To say that cryptocurrency has been a hot topic in financial services of late is a massive understatement. Coinbase announced (via Twitter, natch) that it submitted an application for registration as a Futures Commission Merchant under NFA and CFTC rules. However, the enthusiasm around Coinbase’s FCM announcement was likely offset by the withdrawal of its proposed interest-bearing Lend product after concerns about its security-like features prompted preliminary interest from the SEC. In other regulatory developments, the emergence of technologies for vetting and tracking digital assets for anti-money laundering and know your customer purposes are advancing rapidly. Look no further than MasterCard’s acquisition of CipherTrace as evidence of an increasing focus on transactional activity tracking and the lightning fact evolution of more mature AML/KYC processes for blockchain-based and other digital currencies.

Topics: compliance, video conferencing, cryptocurrency, detections

Examining Recent Collaboration and Chat E-comms Compliance Guidance from ESMA, FCA, FINRA, SEC

It’s clear that the flexibility regulators including ESMA, the FCA, FINRA, and the SEC offered financial services firms around the relatively unfettered use of modern collaboration and chat tools like Zoom, Microsoft Teams, and Webex by Cisco during the pandemic has come to an end. No action relief issued at the outset of COVID-19 has expired, and regulatory missives in the second half of 2021 indicate a marked change of tone and expectations for firms using dynamic communication platforms.

Topics: compliance, chat compliance, surveillance, monitoring, regulations, electronic communications

Topics: video conferencing, zoom, Microsoft Teams, Event

Financial Services Compliance and Coverage for Zoom - Zoomtopia Recap

If you didn’t have a chance to attend Zoomtopia this year, there’s still time to watch the sessions as all are available on-demand. Theta Lake was a sponsor of the show and is a long-time partner of Zoom, offering its users the ability to leverage every aspect of the platform and have full coverage for security and compliance across those communication channels.

Topics: compliance, partner, data leakage, regtech, zoom, supervision

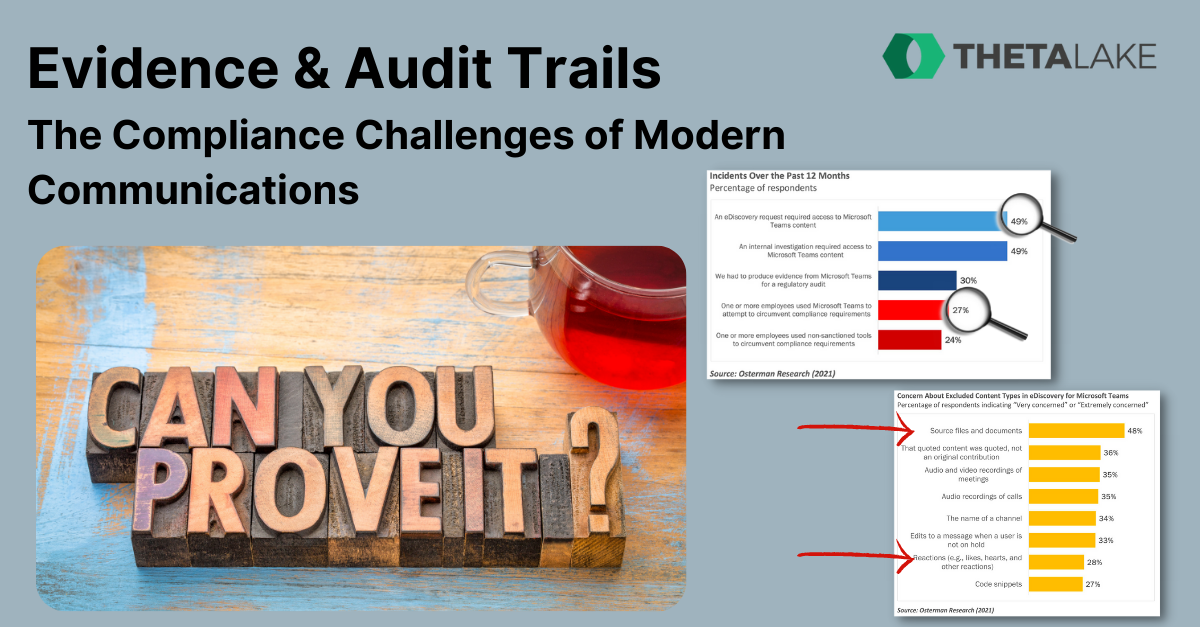

Evidence & Audit Trails - The Compliance Challenges of Modern Communications

Collaboration tools like Microsoft Teams, Zoom and Webex Teams, RingCentral and Slack have become integral to how we work. With multiple ways to communicate and collaborate they’re vital for keeping workforces and customers connected whether remote, hybrid or office based. And with less and less physical in-person interaction, users are making use of the rich features to liaise and share information. Not least by adding personality and emotion with emojis, reactions and GIFs. But modern communications create compliance challenges when it comes to providing evidence and proof that is so often required for regulatory, HR, litigation or complaints resolution issues.

Topics: compliance, chat compliance, record-keeping, financial services, evidence

The Need to Modernize Information Barriers Compliance

As enterprise communications technologies have evolved, the related challenge of managing business rules for groups permitted to use them and communicate with one another have become more complex. In financial services, business information barriers prohibit communications between specific groups to mitigate the risk of misuse of material non-public information (“MNPI”) to prevent market abuse and insider dealing. Information barriers requirements are spelled out in FINRA Rules 2241 and 2242, Section 204A of the Investment Advisers Act, in FCA’s SYSC 10.2 Rule as well as the SEC’s Exchange Act Section 15(g), which requires broker-dealers to:

Topics: compliance, supervision, monitoring

.gif)